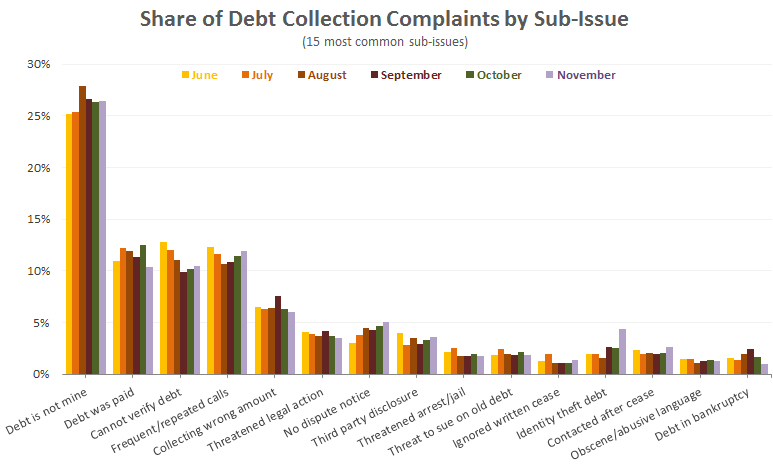

In the six months from June to November 2014, consumers filing complaints concerning debt collection practices shifted their focus somewhat to include more complaints about debts arising from identity theft and “right to dispute” notices in communications.

A number of high-profile court cases and new regulations in New York have prompted a renewed focus on the validation notices used by debt collectors to satisfy the letter of the FDCPA.

The CFPB’s Consumer Response complaints database lists only complaints submitted to the Bureau that companies have had an opportunity to respond to, and does not include complaints referred to other regulatory agencies, complaints found to be incomplete, or complaints that are pending with the consumer or the CFPB. For this reason, the total volume of complaints it publishes is much lower than the complaint numbers previously released by the FTC.

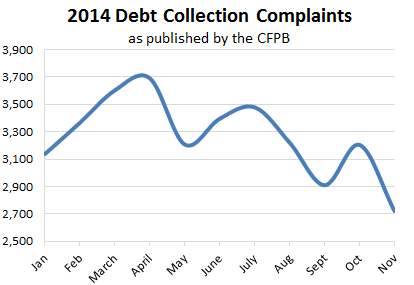

For the first 11 months of 2014, the number of monthly debt collection complaints received by the CFPB, forwarded to companies, and subsequently published by the Bureau has remained fairly steady. There has been variability from month to month, but generally debt collection complaints have fallen into a relatively tight range, averaging just over 3,000 published complaints each month.

For the first 11 months of 2014, the number of monthly debt collection complaints received by the CFPB, forwarded to companies, and subsequently published by the Bureau has remained fairly steady. There has been variability from month to month, but generally debt collection complaints have fallen into a relatively tight range, averaging just over 3,000 published complaints each month.

The CFPB’s complaints wizard steps consumers through the submission process with standardized fields on each screen.

First, consumers must choose which type of debt led to the collection complaint. The most common debt type in the past six months is “Other,” as it has been since launch. The “Other” category covers debts stemming from telecom, health club memberships, cable service and other similar accounts. But that “Other” field has been taking up a larger share of the complaints over time. In November, it made up nearly 30 percent of all debt collection complaints; in October, it went slightly over 30 percent.

It remains to be seen if the CFPB will begin to separate out the debt types that make up the “Other” category. The Bureau did add Payday Loans as an option somewhat recently, and Medical debt complaints have been on the rise.

Next, consumers tell the CFPB what they are complaining about. There is a dropdown with a few options, and then a few more trigger depending on the first selection. That second level, the “Sub-issue,” lets regulators know exactly what prompted the complaint.

The most common issue in every month has been “The debt is not mine.” In October, it made up 26.3 percent of all complaints and in November it was 26.4 percent.

Further down the list there was a big jump in one category from October to November: “Debts arising from identity theft.” In October, those complaints accounted for just 2.5 percent of all complaints; in November, that number rose to 4.4 percent. It is not known whether this is a temporary jump or the beginning of a new trend in consumer complaints.

A sub-issue that has definitely seen steady increases month over month is “Right to dispute notice not received.” That sub-issue is now indicated in more than 5 percent of all collection complaints, up from the low-3 percent area in June.

Dispute notices have been popping up in major FDCPA cases and in state laws recently. In September, the Fourth Circuit Court of Appeals held that a collection agency was liable under the law for continuing to contact a consumer even though the consumer verbally disputed the debt. In July, the Sixth Circuit expanded the requirement for how a debt collector must respond to a debtor’s request for verification of a debt.

And just last month, the state of New York famously codified debt validation requirements, even coining a new word – substantiation.

The CFPB may follow suit when it issues its rules for debt collection this year. If complaint trends are any indication, and the Bureau says they certainly are, we should expect similar language in the CFPB’s proposals.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)