Earlier today we reported that the CFPB has taken the long-awaited next step in debt collection rulemaking activity by releasing an Outline of Proposed Rules in advance of the required Small Business Regulatory Enforcement Fairness Act (SBREFA) consultation process. The formal SBREFA hearing is scheduled for the week of August 22.

The Outline of the CFPB’s Proposed Debt Collection Rules is a 117-page document. However, the guts of the proposals are covered in the first 71 pages. The remainder includes the appendices. There is a lot to digest. The ARM industry will like some elements of the proposal; there are other elements that are likely to cause some heartburn. There is too much to fully address in any one post; therefore we will address the various proposals in a series of analysis articles. This first article addresses the proposals related to voice messages and contact frequency.

Voice Messages

Litigation over voice messages has been a hotbed of consumer litigation for years. Discussion of this topic is contained in the section on Communication with the Consumer.

The Bureau is considering a proposal that would provide that no information regarding a debt is conveyed — and no FDCPA “communication” occurs — when collectors convey only: (1) the individual debt collector’s name, (2) the consumer’s name, and (3) a toll-free method that the consumer can use to reply to the collector.

For example, a voicemail could state, “This is John Smith calling for David Jones. David, please contact me at 1-800-555-1212.” This would allow collectors to leave such limited-content messages in a voicemail message, with a third-party in a live conversation, or through another method of communication (e.g., in a text message or an email), without triggering the requirement to provide the FDCPA disclosures.

The CFPB rationale for this proposal:

“Many collectors (currently) believe that, under the FDCPA, they may not be able to leave voicemails or other messages for consumers because the FDCPA requires them to leave information identifying themselves as a collector and provide certain warnings to the consumer. If such content is seen or heard by a third party, however, that would risk violating FDCPA prohibitions against revealing debts to third parties. As a result, when consumers do not answer collections calls, some debt collectors simply hang up and call back, repeating this process until the consumer picks up the call. This may result in consumers receiving many more collection calls than they presumably would if debt collectors could leave a simple message.”

insideARM believes this proposal is a reasonable, balanced approach, and is positive for the industry. It’s basically what many longtime ARM professionals refer to as the “Pre-Foti” message. This is the solution that was proposed by the Consumer Relations Consortium (a group of “larger market participants” managed by The iA Institute, which also publishes insideARM) in their response to the ANPR.

If ultimately adopted, this would appear to provide a “safe harbor” for collectors to leave messages, reduce frivolous litigation over the content of voice messages, and encourage more communication with a consumer.

Frequency of Contact

Frequency of contact is an area where there is substantial disagreement between debt collectors and consumer groups. It is likely that any proposal will have detractors from both sides. On the other hand, ARM companies should like some definitive direction on number and frequency of contact attempt.

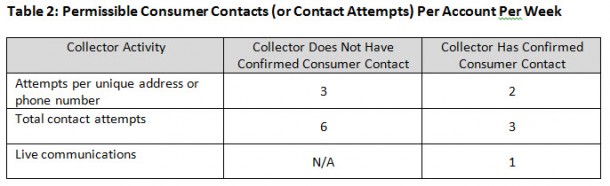

The Bureau is considering proposing regulations limiting the frequency with which debt collectors may contact, or attempt to contact, consumers. In considering proposals to restrict contact frequency, the Bureau believes that it would make sense to establish different numerical restrictions depending on whether the collector has successfully established contact with the consumer who is alleged to owe the particular debt. Under the proposed rules a new term will be added to the debt collection lexicon – “Confirmed Consumer Contact.”

The Bureau is considering a rule that would provide that “confirmed consumer contact” exists once any collector—whether the current collector or a prior one—has communicated with the consumer about the debt, and the consumer has answered when contacted that he or she is the debtor or alleged debtor.

Confirmed consumer contact would not exist either: (1) prior to the consumer answering that he or she is the person whom the collector sought to contact, or (2) if the collector reasonably believes that previously confirmed contact information for the consumer has become inaccurate.

The Bureau believes a bifurcated approach may be appropriate because prior to such “confirmed consumer contact,” the collector may attempt to reach the consumer through different phone numbers or different media and may not know how best to reach the consumer. Once the collector has reached the consumer and confirmed that certain contact information is effective, the collector will know how best to reach the consumer and need not attempt to initiate contact as frequently.

insideARM suspects that this new term will lead to additional consumer litigation. It bolsters the argument for recording all phone calls.

The contact caps under consideration would limit both successful and attempted contacts. For instance, a contact attempt that ends with the collector leaving a limited-content message as described above would count toward the cap. The bureau also considered applying the contact caps on a per-consumer, rather than on a per-account, basis for all types of debts, but smartly rejected that concept.

The Bureau is also considering whether to apply the contact caps equally to all communication channels (e.g., telephone, mail, email, text messages, and other newer technologies), and whether to create separate limits per unique phone number or address as well as for total contacts per week. The acknowledgement of electronic communication in this section and elsewhere throughout the Outline is interesting. It lends some hope that the ultimate rules will recognize and account for greater and easier use of electronic communications throughout the collection process. More and more consumers prefer and want electronic communication instead of communication via a telephone call.

The Bureau is considering whether to structure the caps as “hard” bright-line limits or to provide more flexibility. For instance, one option would be to establish a general bright-line rule but with some specific exceptions. Another option would be to establish a rebuttable presumption that contacts or attempted contacts above the threshold constitute harassing, oppressive, or abusive conduct, and contacts or contact attempts at or below the thresholds do not.

Under such an approach, if the collector knew or had reason to know that a contact or contact attempt in excess of the cap would not result in harassing, oppressive, or abusive conduct for a particular consumer, the collector would not violate the regulation by contacting or attempting to contact the consumer more often than the thresholds otherwise would allow. On the other hand, if the collector knew or should have known that a contact or contact attempt below the threshold would be harassing, the collector would violate the regulation by contacting or attempting to contact the consumer at that frequency. It will be interesting to see the responses to these alternatives.

The following chart depicts the proposed contact caps for communication with consumers. Note: The caps are per account and per week.

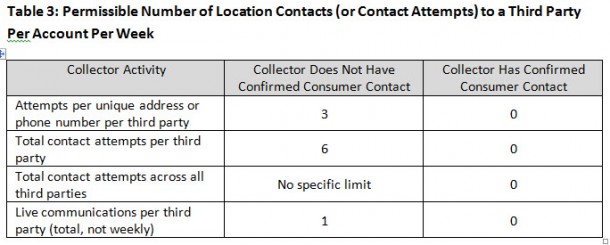

The Outline also discusses proposed contact caps for location attempts and general third party contacts. The Bureau is considering a set of contact caps that would allow collectors to make a limited number of location contacts (or attempted location contacts) with third parties when the collector does not have confirmed consumer contact. Like the consumer contact caps under consideration, the contact caps being considered for location communications would: (1) apply to all contact channels; (2) restrict both attempts per unique address or phone number and total attempts per week; and (3) apply per account, rather than per consumer.

The following chart depicts the proposed contact caps for Location Contacts (or Contact Attempts) to a Third Party Per Account. Note: These caps are also per account and per week.

It will be interesting to see how the CFPB proposed rules on Frequency of Contact compare with the Federal Communications Commission (FCC) proposed rules on Frequency of Contact for collection of Federal Debt. See our May 9, 2016 article on the FCC Notice of Proposed Rulemaking on the collection of government debt. In the NPRM the FCC proposed a 3 call per month limit. Also See our July 25, 2016 article on FCC Chairman Wheeler’s blog on the issue. It makes no sense to have two separate sets of call limits, one for federal debt and another for all other types of debt.

As we mentioned in the brief insideARM Perspective on our other article today, it’s clear that the CFPB has done its homework over the last three years to understand the debt collection business. This separation of call limits by pre- and post-consumer contact is a prime example. This is also a topic that the Consumer Relations Consortium focused on in multiple conversations with the Bureau. The group felt it was important that the CFPB understand there is a difference between the effort required to make contact in the first place, and the optimal follow up frequency once contact has been made. While many assume that any weekly limit set for call attempts will be multiplied by an indefinite number of weeks, generating a dramatically large number, this is not the reality of what happens in most cases. insideARM applauds this attempt to appreciate this important nuance in the process.

_____________________________________

Read insideARM’s detailed coverage of the CFPB’s Outline of Proposed Rules

CFPB Outlines Debt Collection Rulemaking Proposals

insideARM Perspective on CFPB Outline of Proposed Debt Collection Rules – Communication Part 1 (Contact frequency and voicemail messages)

insideARM Perspective on CFPB Outline of Proposed Debt Collection Rules – Communication Part 2 (General time, place, and manner restrictions; decedent debt; and consumer consent)

insideARM Perspective on CFPB Outline of Proposed Debt Collection Rules – Information Integrity (Data integrity, data transfer, substantiation, validation notice)

What Collectors Really Need to Know About the CFPB’s Proposed Rules - a podcast by Attorney John Rossman

15 Industry Experts React to CFPB Outline of Proposed Debt Collection Rules

Webinar: CFPB Rulemaking and Overview (August 16, repeated on August 18) – free for Compliance Professionals Forum members; $59 for others

President of FMA Alliance Shares Experience at Debt Collection SBREFA Hearing

Creditor Rights Law Firms Well-Represented on CFPB’s Small Business Review Panel

Small Business Representative Shares Her Thoughts About Yesterday’s Debt Collection SBREFA Hearing

![Photo of Tim Bauer [Image by creator from ]](/media/images/tim-bauer.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)