Consumer credit in the U.S. increased in September for a second straight month, led mostly by increases in auto and student loans. Credit card debt fell in the month after an increase in August.

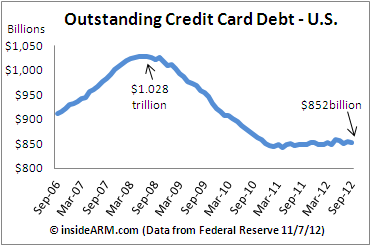

The Federal Reserve reported that outstanding revolving credit, primarily credit cards, fell by $2.9 billion in the month, or at an annualized rate of 4.1 percent, to $852 billion.

The growth and contraction of credit card debt has been uneven for at least the past year, with wide monthly fluctuations.

But broader trends show that consumers are beginning to use their credit cards more after a three-year precipitous decline. Since bottoming out at around $842 billion in April 2011, consumers have added about $10 billion to outstanding credit card balances.

Non-revolving debt in September increased $14.3 billion, an annualized rate of 9.2 percent, to $1.88 trillion. In a separate report, auto makers said that demand for cars and trucks hit a four-and-a-half year high, driving much of the gains. Direct student lending by the federal government also jumped in September.

Non-revolving debt in September increased $14.3 billion, an annualized rate of 9.2 percent, to $1.88 trillion. In a separate report, auto makers said that demand for cars and trucks hit a four-and-a-half year high, driving much of the gains. Direct student lending by the federal government also jumped in September.

Total consumer credit outstanding as tracked by the Fed in its monthly Consumer Credit report (G.19) was $2.737 trillion at the end of September.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)